It probably seems like a lifetime ago, but before the internet, how did people actually search and assess information to buy cars? Drivers used to leaf through dense catalogues, were enticed by large-scale above-the-line advertising and visited showrooms to road test the latest models.

However, this all seems like an ice age ago as now the vast majority of buyers won’t leave the comfort of their homes before even thinking of purchasing a vehicle, due to the vast wealth of information available at their fingertips. A study has revealed that only 2% of car buyers <http://www.datamentors.com/blog/key-insights-understanding-2016-car-buyer%E2%80%99s-journey> spend time shopping for cars through print materials such as newspapers, whereas 88% use the internet to search for information and consider their options.

It’s clear that many consumers now walk into a dealership having already researched online various models, and pretty much decided upon the car they wish to purchase. According to a survey of 2,000 consumers, conducted by DMEautomotive, 16% of car buyers <http://www.forbes.com/sites/jimgorzelany/2014/04/25/car-buyers-flunking-their-test-drives-stats-show-heres-how-to-do-it-right/#4b0c0da622c3> skipped out on testing a car before purchasing it, and 33% only took a single model out for a drive before buying.

Meanwhile, in the UK, it is much the same too. Hyundai have launched <http://www.campaignlive.co.uk/article/hyundai-launches-uks-first-entirely-online-car-buying-platform/1420389> the UK’s first entirely online car-buying platform which allows users to configure their desired vehicle, get a price for their trade-in, and arrange finance and a deposit all from their laptop or mobile device. The new car market continues to grow with a 7% increase year-on-year

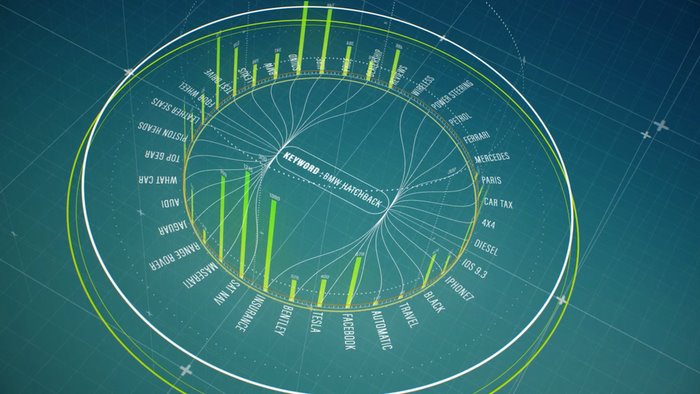

<http://advertising.autotrader.co.uk/uploads/resources/Quarterly-Market-Tracker-Q2-2015.pdf> , with the biggest motivation for buying being a desire for ‘change’. As consumer confidence continues to grow, and with the volume of information available via search on the internet, people are more concerned about finding a car that fits and matches their current life situation and advertising strategies need to be synced to mirror the market’s changing intentions’. Automotive brands can again deeper insights into consumers’ intent by looking into their search behaviours to distinguish what consumers really want in comparison to what they aspire to own.

A study from Autotrader indicated that 49% of UK consumers <http://jalopnik.com/turns-out-a-lot-of-car-buyers-dont-even-bother-with-tes-1568112788> spent fewer than 30 minutes on a test drive to make an informed decision about purchasing. Further data has shown that 38% of buyers <http://www.datamentors.com/blog/key-insights-understanding-2016-car-buyer%E2%80%99s-journey> only visit one dealership, and 52% only test drive one vehicle.

In tandem with this huge shift in how consumers buy vehicles, there has also been substantial changes in what they expect from today’s models.

While the industry is undoubtedly in rude health in the UK, a new trend has been consumers increasingly demanding alternatively-fuelled vehicles. This type of model has been the fastest growing vehicle-type, with 25% growth in 2015 alone. Most welcoming for consumers is also that it is estimated that the initial cost of the models will reach parity with their petrol counterparts by 2025 <http://www.cityam.com/211340/electric-cars-and-new-fuels-could-slash-costs-driving-and-add-5bn-uk-gdp-2013-says-cambridge> . With the increase of technology in innovating new environmentally eco friendly products, consumers expect car brands to create products that will have a positive impact on our ecosystem and many are already looking to alternatively-fuelled vehicles despite having, currently, a more expensive price tag.

It’s important that manufacturers bear this inclination in mind when advertising their latest models, as electric cars gradually come to claim a large stake in the market. Although some consumers are concerned about the lack of infrastructure to support electric-powered vehicles, several large car firms – including BMW and Ford – have just announced <http://www.bbc.co.uk/news/technology-38147478> their collaborative effort to build 400 charging sites across Europe, a significant development in the coming years.

As consumer demand shifts to favor more economical and energy-efficient vehicles, manufacturers need to proactively capitalise on the technology in demand. Interestingly, those consumers that look to purchase high-end cars tend to search for the sustainability and technology on offer, whilst concerns over safety takes, unfortunately a back-seat. This was evident in the industry buzz of 2016, with search focussing on Google self-driving cars and Tesla, and factory closures and industry scandals being forgotten in the process.

As technology advances in everyday life, drivers expect to see the latest car models released with innovative features such as wifi hotspots and wireless charging. However one of the most anticipated trends to come to market is driverless technology. Many companies are already testing the technology in a race to become the first autonomous ride sharing service. BMW have announced their plans to have 40 self-driving cars operating on the streets of Munich <http://uk.businessinsider.com/r-bmw-seeks-to-be-coolest-ride-hailing-firm-with-autonomous-car-2016-12?r=US&IR=T> next year, and Apple <http://news.sky.com/story/apple-reveals-it-is-investing-heavily-in-driverless-cars-10683224> have also recently announced their intention to develop their own line of driverless car. The news of this innovation is coming at a pivotal time, one where – according to Ford – people living in cities are finding their commute more stressful than their jobs. In addition, Ford’s survey <http://www.connectedcar-news.com/news/2016/nov/30/80-people-using-driverless-cars-would-relax-and-enjoy-scenery-ford-survey-says/> found that Europeans spend the equivalent of 10 days per year in their cars; autonomous cars are set to shake this up and the benefits are countless, and could even be the end for parent-taxi drivers, 16% of which <http://www.connectedcar-news.com/news/2016/nov/30/80-people-using-driverless-cars-would-relax-and-enjoy-scenery-ford-survey-says/> said they’d trust their child to travel alone in a driverless car.

For 2017, the challenges car manufactures will face will be centred around meeting consumers’ ever-shifting demands and lifestyle changes. With 5G becoming a reality in the UK many new car buyers will be looking to purchase models that offer appropriate connectivity support, allowing users to browse the internet at high-speed without draining their phone battery. Connectivity doesn’t stop there, in addition to the age-old bluetooth functionality, many users are looking for cars that support in-car app compatibility. With Apple CarPlay and Android Auto gaining traction, the ability to connect your apps in the car has become crucial to keep people from looking at their smartphones whilst driving.

If manufacturers can look to keep up-to-date with the latest tech innovations, and in turn offer functionality for any advancements that may occur in the near future, customer interest and search should continue to increase while confidence in the market grows.

About Vincent Potier, Chief Operating Officer (COO), Captify

Vincent <https://www.linkedin.com/in/vipotier> is the COO of Captify and joined the company in 2013.

He is a renowned digital expert and a well known industry commentator on issues including ad blocking and data protection legislation, he’s also a member of the Interactive Advertising Bureau (IAB) behavioural targeting council.

Throughout his career, Vincent has held a number of prominent roles across Europe, Asia and Latin America, consulting on digital strategies in the adtech, agency and client space. These roles included VP, Strategy & Business Development at Universal Mobile, and Director of Marketing and Communications at Vizzavi. Before Captify, Vincent was the Managing Director for Vonage UK and Canada, where he was responsible for the financial and commercial turnaround of the business.

5G Automotive Association and European Automotive Telecom Alliance Sign a Partnership MoU

5G Automotive Association and European Automotive Telecom Alliance Sign a Partnership MoU SmartDrive Appoints Analytics Veteran Ray Ghanbari as Chief Technology Officer

SmartDrive Appoints Analytics Veteran Ray Ghanbari as Chief Technology Officer ConMet and Protean Electric join forces to develop Electric In-Wheel Drive System

ConMet and Protean Electric join forces to develop Electric In-Wheel Drive System AW North Carolina Looks to AT&T to Help Secure Business Operations

AW North Carolina Looks to AT&T to Help Secure Business Operations GOVERNMENT NEEDS TO TAKE ACTION TO ENSURE UK BENEFITS FROM AUTONOMOUS VEHICLES, LORDS REPORT SAYS

GOVERNMENT NEEDS TO TAKE ACTION TO ENSURE UK BENEFITS FROM AUTONOMOUS VEHICLES, LORDS REPORT SAYS Acquisition of Mobileye Drives Intel into Leading Position for Autonomous Car Market, IHS Markit Say

Acquisition of Mobileye Drives Intel into Leading Position for Autonomous Car Market, IHS Markit Say