“Programmable silicon will enable smart cameras to better adapt to challenging viewing conditions in much the same manner as the human eye.†Harvey Steele, Director of Automotive Product Line at Xilinx.

The demanding nature of the automotive industry, coupled with constantly changing standards and introduction of new consumer-based applications into the vehicle, makes designing electronics for the automotive market an extremely complex and dynamic undertaking.

Automotive Industries discussed the future of automotive electronics with Harvey Steele, Director of Automotive Product Line at Xilinx.

Analysts forecast the worldwide semiconductor market for in-car audio, infotainment and driver information/telematics to grow from US$5.6-billion in 2003 to US$12.8-billion in 2010. Market leader in programmable solutions for the automotive market is the US$1.7-billion Xilinx company, which produces semiconductor chips capable of being programmed individually for use in a wide range of electronic systems. It also develops the software design tools necessary to program these chips and predefined system functions which customers load as intellectual property (IP) into Xilinx logic devices. The Xilinx product portfolio includes a wide breadth of both Field Programmable Gate Arrays (FPGAs) and other Complex Programmable Logic Devices (CPLDs).

Within the European luxury vehicle market, the MOST multimedia bus has become the de facto standard. Outside this segment, adoption of MOST has been stifled by a limited supply base, slow technology evolution, and cost. In fact, there has long remained a sole supplier of MOST controller devices. While changes are coming that will address concerns regarding cost and network speed, they do nothing to address the issue of truly open standards and choice. Additional suppliers and more flexible solutions are needed to invigorate this market.

The Xilinx MOST solution, developed in conjunction with its partner, Gothenburg, Sweden-based Mocean Laboratories AB, includes Xilinx XA FPGA devices, LogiCORETM MOST controller IP and Mocean’s Network Services middleware layer. Mocean, a long time collaborator with major OEMs on MOST and the world leader in MOST soft IP, is also providing additional components of this solution including data routing and Digital Rights Management (DRM).

Xilinx MOST makes it possible to accelerate the integration of consumer/home electronics into vehicles. As MOST adoption increases, these infotainment systems will migrate from the luxury vehicle segment, to the premium and midline segments. Since the MOST network allows for easier plug-and-play communications amongst infotainment modules, OEMs can offer consumers more options when buying a vehicle.

Automotive Industries recently spoke to Harvey Steele, Director of Automotive Product Line at Xilinx, about the future of automotive electronics.

Automotive Industries (AI): Given the traditional use of PLDs, why are they now considered a viable option for the automotive market?

Steele: In automotive, PLDs have traditionally been used for concept development and prototyping. The migration to smaller device geometries has changed the economics enabling PLDs to be considered a viable option for high-volume automotive production applications. In fact, PLDs have become especially well suited for this market due to the high adoption rate of new and emerging consumer functionality into the vehicle. This requires a flexible architecture, which by its very nature is available with a PLD.

AI: What percentage of Xilinx revenue comes from the automotive sector and how much is that revenue expected to grow over the next couple of years?

Steele: The automotive XA program was announced just two years ago. Today it is a small, but rapidly growing, percentage of Xilinx total revenue. However, automotive is viewed as a very important market segment for Xilinx and as such, we have brought in automotive industry veterans to lead this effort. We currently have over 30 percent growth annually. Thanks to the explosion of infotainment, driver assistance, comfort and convenience and in-vehicle networking applications, that revenue is forecast to continue its move forward.

AI: How will the launch of MOST in-vehicle multimedia networking IP, later this year, impact Xilinx?

Steele: The MOST solution that Xilinx will offer is significant to the automotive market in general. Very few semiconductor players have introduced MOST hardware to date. With limited hardware, middleware and software choices to implement MOST in-vehicle, customers have been forced to make decisions based on what was available, as opposed to on what they really wanted to do. Not only is the FPGA re-programmable, but the Xilinx MOST IP and middleware solution is scalable; thereby allowing customers to consider new system partitioning alternatives which, in many cases, will be able to better meet their needs. With the availability of the Xilinx LogiCORETM controller, customers will be able to increase integration and reduce overall system costs by choosing to eliminate a separate transceiver chip. Consequently, with a simple physical layer, an FPGA can communicate directly with the MOST bus.

AI: Will Xilinx need to adapt its products in order to use the MOST multimedia network protocol? If so, please explain how?

Steele: No, the XA line of physical hardware will not change. However, since the Xilinx MOST offering highlights our “system solutions†approach to automotive applications we want to provide not only the hardware (e.g. the physical FPGA in this case), but also the IP, middleware and development systems necessary for customers to quickly and effectively implement designs. As a result, we have worked diligently with Mocean on the Xilinx MOST solution. Mocean brings a wealth of middleware and IP to the table which compliments our MOST LogiCORETM IP development. Mocean’s expertise and dedication have been instrumental in helping us bring our full MOST solution to fruition, and the company will continue to be an important multimedia partner for us beyond this initial MOST development. In addition, we have partnered with San Jose, CA-based IDT who will provide a custom MOST PLL/clock recovery chip.

AI: Please describe some of the changes you expect in automotive electronics as a result of the Xilinx MOST solution launch?

Steele: We expect to see a further pick-up by tier one customers in the usage of Xilinx FPGAs; especially in the infotainment space. We believe that the addition of the MOST solution to our broad portfolio of IP and software, coupled with the fact that we have automotive qualified silicon, will afford our customers a number of benefits, including the ability to integrate more of their architecture onto the FPGA, scale as needed for their application or platform, and get to the market with the speed necessary to be competitive.

AI: Will your current automotive market strategy change because of MOST and if so, how?

Steele: No. We will build full system solutions for the automotive market wherever the flexibility of our programmable hardware can add value. With MOST, we are just scratching the surface. While we certainly plan to expand our XA silicon product line moving forward, we will also continue to focus on the IP and software required to optimize ease of use and give system designers flexibility in architecting these increasingly complex automotive systems. Yes MOST is an important part of our strategy, but in general, Xilinx solution focus will continue to evolve with the needs of our customers, as well as that of the automotive electronics market.

AI: What are some of the challenges facing a company like Xilinx, in terms of designing products for the automotive segment? For example, are there any new infotainment applications car makers wish to add in vehicles?

Steele: Xilinx is constantly looking ahead at the needs and future ‘wants’ of our automotive customers. By doing so we can ensure that we have the right mix of hardware, IP and software ready to meet any market demand. Xilinx has always been a leader and innovator in the PLD market. Now, we are working to leverage that leadership position and culture of innovation for use in the automotive market. That goal entails making sure that we keep our eyes on emerging and future technology. Infotainment, for example, is seeing many changes as consumer protocols find their way into vehicles. Driver assistance is also growing rapidly, with camera-based applications for lane departure warning, back-up assist and others now starting to hit mainstream vehicles. We are investing heavily in the consumer and audio-video broadcast vertical market segments, as well as in our embedded processing and DSP technologies. We expect to see much of this cutting-edge technology making its way into vehicles in the next few years.

AI: Can you venture to predict any technological breakthroughs which may occur in automotive electronics in the next few years?

Steele: Camera-based driver awareness applications will continue to grow. Also, programmable silicon will enable smart cameras to better adapt to challenging viewing conditions in much the same manner as the human eye. This capability will allow an unprecedented level of awareness by the vehicle of its surroundings. It is sure to inspire a host of advanced vehicle functions to keep drivers more ‘aware’ and allow them to better deal with threats. The ability of vehicles to better communicate with each other will further increase both vehicle and driver awareness of surroundings. Along with this breakthrough though, comes the challenge of dealing with even larger quantities of data which must be processed extremely fast. This, in turn, will mandate the use of faster processors and/or parallel logic, such as ASICs or FPGAs.

MOST is a registered trademark of OASIS SiliconSystems and licensed to Xilinx.

More Stories

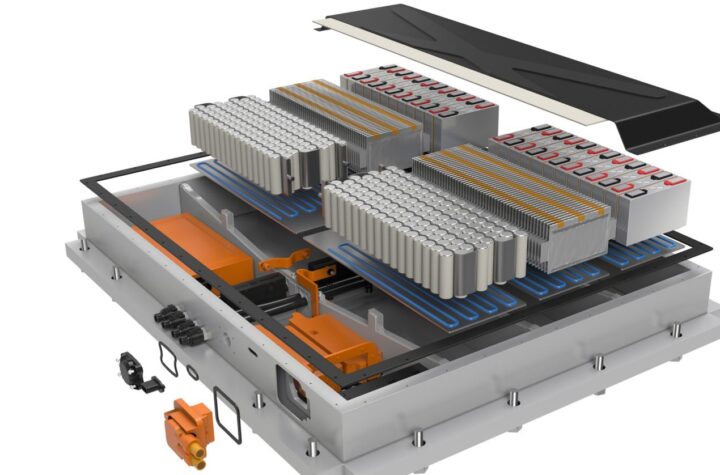

DuPont materials science advances next generation of EV batteries at The Battery Show

Cybord warns of dangers of the stability illusion

Avery Dennison PSA tapes support rapid evolution of EV batteries