Global automotive software market size is largely fueled by escalating consumer demand for comfort, safety and convenience in vehicles. Growing integration of technologically advanced features in vehicles such as smart electric roof, ADAS, walk away safety lock and cooled glove box have resulted in increased number electronic components in vehicles.

Emergence of technologies such as AR, AI and blockchain will significantly enhance fuel-efficiency, functional safety, streamlined key entry and infotainment features. Proliferation of EVs and HEVs, rising internet penetration and increasing adoption of connected cars are anticipated to boost automotive software industry outlook.

Increasing R&D investments by software majors such as Wipro, NVIDIA and Bosch Software will propel innovations in software products. These companies are also are looking towards partnership strategies to design and develop autonomous vehicles. For instance, Bosch and Daimler had partnered in 2018 to run a test program for autonomous on-demand ride-hailing service.

Autonomous driving software market share is projected to register a robust 17% CAGR over 2019-2025.

Accessibility of cloud-based services at remote locations coupled with increasing vehicle connectivity is driving the business growth. Increased focus on reducing operation cost for OEMs along with surging demand for efficient data visualization and data analysis has led to increased use of vehicle management software. These software help deliver timely services through predictive diagnostics, enabling carmakers to boost customer satisfaction.

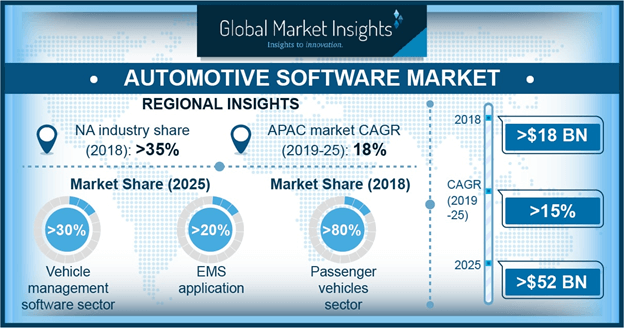

Vehicle management software segment accounted for almost 32% of total automotive software industry share in 2018.

Rising preference for Mobility-as-a-Service (MaaS) is positively contributing towards automotive software market forecast. Industry giants such as Ford, Delphi and General Motors are making significant investments to design and develop driverless cars. For instance, Cruise Automation, a self-driving unit of General Motors had partnered with Honda in October 2018 for large-scale deployment of autonomous vehicle technology.

The mobility service segment of automotive software industry will observe unprecedented growth at more than 19% over the projected period.

Strict government norms pertaining to environmental safety coupled with mounting environmental concerns have encouraged OEMs to design fuel-efficient engines with minimum carbon emissions. OEMs are incorporating EMS products along with hi-tech sensors for applications such as air management, fuel supply, ignition and control fuel injection to enhance engine efficiency.

Automotive software market size from engine management system (EMS) segment held close to 20% of the global business share in 2018.

Anti-lock braking system (ABS) helps ensure passenger and driver safety by preventing sudden skidding and consequent road accidents. The technology has significantly reduced risks of road crashes in recent times. For instance, it was reported in September 2015 that ABS lowered the risk of run-off road crashes by nearly 33%.

Automotive software market size from anti-lock braking system (ABS) application is anticipated to witness gains at over 14% during the analysis timeline.

Growing dependence on public transportation and ridesharing services coupled with rising number of projected to bring autonomous trucks into logistics has increased the demand for automotive software across the commercial vehicles segment. Strict regulations enforced by the government and other regulatory bodies to ensure environmental sustainability is proliferating the business growth.

Commercial vehicles segment in automotive software industry will witness a remarkable 18% CAGR up to 2025.

Passenger vehicles segment is anticipated to observe steady growth during the forecast period. Growing deployment of smart technologies in passenger vehicles has led to increased demand for in-vehicle electronics systems, creating great significant opportunities for automotive software in the passenger vehicles segment.

Evolving trends of industrialization and infrastructural development in emerging economies such as China and India are opening up opportunities for automotive OEMs. Asia Pacific automotive software market size is anticipated to record a high growth with a robust CAGR of over 17% during 2019-2025. The need to address traffic congestion issues and accidents in APAC countries through the use of predictive navigation and other products will bolster the industry scope.

More Stories

DuPont materials science advances next generation of EV batteries at The Battery Show

How a Truck Driver Can Avoid Mistakes That Lead to Truck Accidents

Car Crash Types Explained: From Rear-End to Head-On Collisions