Morocco is leveraging its ready access to the European automotive market with an established and growing automotive base to attract more car makers and suppliers to the country.

Morocco’s auto industry has been undergoing steady growth, and experts predict the country will have the capacity to produce a million cars in the short term. Morocco was recently labelled as Africa’s leading auto manufacturing hub, ahead of the auto industries of both South Africa and Egypt. The country is also expected to soon outpace Italy in vehicle production.

The Kingdom is Africa’s first passenger car manufacturer. In 2019, The Moroccan automotive industry comprised over 250 companies, creating over 220,000 direct jobs with a local integration rate of 60% and an installed capacity of 700,000 vehicles. All targets set by the Government in partnership with industrialists were surpassed.

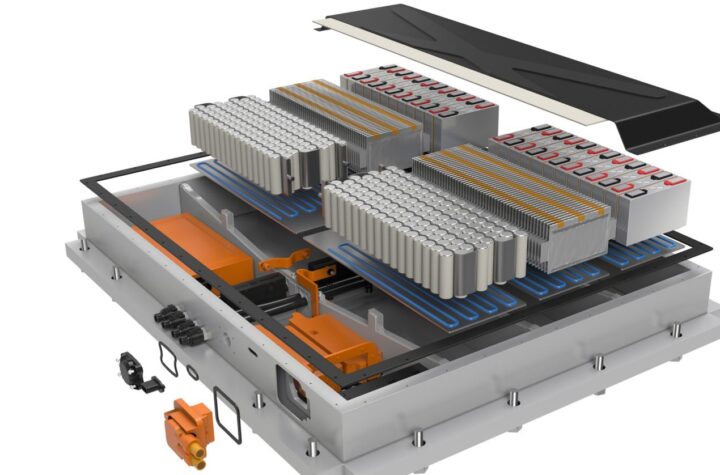

Today, the industry is structured into efficient ecosystems including wiring, metal &stamping, battery, vehicle interior and seats parts, powertrain, engine and transmission, covering all the value chain.

According to the Morocco World News, the country’s industry minister, Moulay Hafid Elalamy, believes its automotive industry has the potential to be more competitive than China and India.

Automotive Industries (AI) asked Ayda Fathi, Business Development Director – Automotive Industry Moroccan Investment & Export Development Agency, how Morocco has emerged as a leading automotive manufacturing hub.

Ms. Fathi: The history of the national automotive industry starts in the 1960s with the establishment of the pioneering Somaca factory in Casablanca. Wiring subsidiaries of multinational companies were the next to invest. The industry has gained momentum since the beginning of the 2000s, thanks to the support given by His Majesty the King, May God assist him.

A turning point was the opening of a one-billion-euro manufacturing plant in Tangier during February 2012 by French carmaker Renault. It is the largest automotive plant in Africa and has attracted a growing number of suppliers.

Among the reasons of choosing Morocco are political stability, a long-term clear vision, a strategic geographical location, a world-class infrastructure, exemption from export duties, and the advantages of industrial export zones.

The momentum gained pace with the introduction of The Industrial Acceleration Plan. It’s a five-year plan launched in 2014 with the aim to develop competitive clusters, increase vertical integration Multinationals companies/Small and medium businesses and build ecosystems cross industries, rebalance trade. An industrial fund of 20 billion USD was created to support this implementation of this strategy. Main objectives were defined and achieved with the private sector: Raise the share of industry in global GDP by 9 points; from 14 to 23% and create creating 500,000 jobs, half of them through foreign investments.

Support through the plan includes a land lease offer to reduce CAPEX, training incentives and packages tailored to different types of business structure.

In 2019, the attractiveness of the automotive sector was confirmed with the opening of a PSA Peugeot Citroën factory in Kenitra, a city located less than 125 miles south of Tangier. PSA is the second carmaker to opt for Morocco.

PSA group’s plant in Kenitra, designed to produce both electric and thermal vehicles, started with a local content of 60%, aiming to reach 80%. Its annual production capacity is 200,000 vehicles.

Besides, Morocco has made the shift to electric mobility. The Citroën AMI, an electric car measuring 2.41 meters long, with a speed limited to 45 km / h and a range of 70 kilometers, is produced at PSA plant in Kenitra.

In 2017, PSA Group inaugurated the Morocco Technical Center (MTC), a Moroccan R&D center supporting the group’s industrial facilities in the region and developing R&D activities associated with the regional product plan and local integration. On the other hand, PSA has signed an advanced research agreement with 9 Moroccan or based in Morocco universities and schools. In this regard, the OpenLab (1st in Africa) “Sustainable mobility for Africa” has launched a four-year research program to explore sustainable mobility systems around three main axes: electric mobility, renewable energies and logistics of the future. The PSA R&D ecosystem counts 3000 Moroccan engineers, a thousand within the Morocco Technical Center and 2000 Moroccan engineers with their local partners.

AI: What were the key drivers that made Morocco become a leading manufacturing hub for the automotive industry?

Ms. Fathi: Companies seek a favorable environment before investing in a country. The Kingdom enjoys political stability, solid economic fundamentals with sustained GDP growth and inflation under 2%. The country has gained 75 positions in the World Bank Ease of Doing Business index since 2010 and expects to be on the top 50 in 2021.

Morocco is known as a “low risk” country. Over 100 investment protection and anti-double taxation agreements have been concluded between the country and partner countries. There are no restrictions on holding 100% of the capital of Moroccan subsidiaries by international operators and repatriating capital and dividends. Exporters enjoy exemption from tariffs in key markets thanks to free trade agreements signed with the European Union, the United States of America, Turkey, some Arab countries, and more recently with African countries.

Less than nine miles from the south of Europe, Morocco enjoys a strategic geographical location. The country has invested heavily in the development of world-class infrastructure, including the Tanger Med port in the north of the country. It is the largest port in Africa and the Mediterranean Sea and connects over 186 ports worldwide. Carmakers and equipment manufacturers based in Morocco export to more than 70 automotive platforms around the world.

Several latest generation industrial zones, labelled “Industrial Acceleration Zones”, have been developed. These zones offer advantageous tax incentives and “one-stop-shop” services with a very competitive launch cost.

The Kingdom has provided companies operating in the car industry with dedicated training institutes called “IFMIA”, Institut de Formation aux Métiers de l’Industrie Automobile, to meet their needs in terms of skilled workforce. The State also grants training subsidies to these companies.

Indeed, Morocco has a large pool of qualified labor with all the ingredients to become the pivots of competitiveness and value creation: education level, cultural openness, language skills and new technologies, adaptation capacity to change and competitive labor costs. Morocco has nearly 500,000 students in higher education and has set up ambitious training programs to provide the market with qualified resources such as the “25,000 engineers per year” program by 2025.

Drawing on this pool of skills, automotive companies are localizing, more and more, engineering operations within Morocco, either directly or through engineering companies. This engineering and development ecosystem includes SNOP Groupe FSD, Antolin, TE Connectivity and Adient.

AI: What are major achievements of Morocco in the automotive sector?

Ms. Fathi: Morocco leads the African automotive industry with a production capacity of 700,000 cars a year. Automotive exports totaled approximately $8.5Bn in 2019. Automotive is the first exporting sector of Morocco ahead of Phosphates, knowing that Morocco is the largest exporter of Phosphates in the world.

In the first trimester of this year, the country was the second largest supplier to Europe in terms of number of cars.

The supply chain is made of over 250 global players and SMEs serving Europe and the United States of America. They include leading companies such as CITIC Dicastal, AGC, Hands Corporation, Sumitomo, APTIV, Snop Groupe FSD, Antolin, Simoldes, ADIENT, Magna, Nexteer, Varroc and Valeo. the local integration rate is currently 60%.

The strategic choices of the Kingdom, thanks to the impetus given by His Majesty the King, May God assist him, such as massive investment in the development of renewable energies, innovation and human capital, allow us to adapt to the global changes in the sector. This includes the technological transition to electric, hybrid and connected vehicles. Morocco is one of the world leaders in energy transition, with the share of renewables in its energy mix (solar and wind energies mainly) expected to reach 52% by 2030.

Morocco has the very strong ambition to bring his automotive industry to the highest level of competitiveness. All the groundwork has been done. It will be possible by opting for renewable energies (mix of solar and wind energies) as an energy source and expanding the local integration rate to 80%. Using renewables would make production carbon free and cost competitive.

AI: How has the Covid-19 crisis affected Morocco’s attractiveness to automotive investors?

Ms. Fathi: The fundamentals of Morocco’s offer remain unchanged. It is the most competitive platform serving Europe.

As a matter of fact, an agreement with Renault and The Ministry of Industry, Trade, Green and Digital Economy was just concluded. The car maker will integrate the Group’s electric mobility technologies into new cars being made in Morocco. Renault also agreed to purchase 3 billion euros from the Moroccan industrial base.

The Moroccan automotive industry has shown great resilience. As a matter of facts, exports of the first quarter of 2021 exceeded the same period of 2019. All investments planned were confirmed.

In this context of post-Covidrecovery, cards have been reshuffled. Equipment manufacturers are determined to set up production lines that are more resilient, to secure sourcing and to optimize value chains. In fact, new economic models, that are promoting strategic autonomy, are setting up. In this new context, Morocco’s attractiveness is being raised.

In addition to this, to achieve an 80% integration rate, missing links were identified, and business cases developed for investments needed to support the growth.

Brexit should also be mentioned as an opportunity, as the United Kingdom is looking for alternative production areas.

Finally, the implementation of the “carbon tax” by the European Union will favor low-carbon production areas. Morocco is well-positioned to adapt to this change, thanks to the use of renewable energy and the decarbonization of industrial production.

More Stories

DuPont materials science advances next generation of EV batteries at The Battery Show

How a Truck Driver Can Avoid Mistakes That Lead to Truck Accidents

Car Crash Types Explained: From Rear-End to Head-On Collisions