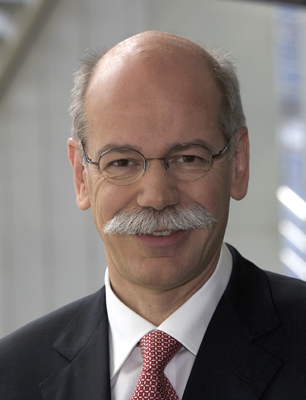

Speaking at the announcement of the purchase of the majority interest in the Chrysler Group by Cerberus, Dr. Dieter Zetsche, Chairman of the Board of Management of Daimler AG, said existing projects with the Mercedes Car Group would be continued. These include the development of conventional and alternative drive systems, purchasing, and sales and financial services outside the NAFTA region. Furthermore, a Joint Automotive Council will be established in which representatives of both sides will assess and decide on the potential of new and current projects. The Council will be led by board-level members from each company. “We very much look forward to our continued cooperation as business partners, as we want to continue to reap the mutual benefits of working together. That’s one of the reasons why we’re retaining a 19.9% equity position in Chrysler,” he said.

An affiliate of private equity firm Cerberus Capital Management, in New York, has taken an 80.1% equity interest in Chrysler Holding. DaimlerChrysler holds a 19.9% equity interest in Chrysler Holding. The company controls 100% Chrysler Corporation, which produces and sells Chrysler, Dodge and Jeep vehicles, and Chrysler Financial Services, which provides financial services for these vehicles in the NAFTA region.

Due to the new corporate structure, the name of DaimlerChrysler AG is being changed to Daimler AG. The Board of Management of the new company will be reduced to six members. Tom LaSorda, Eric Ridenour and Tom Sidlik left the Board of Management with the Group. There will no longer be a separate board position for procurement in the new Daimler AG. In the future, all procurement activities will be directly coordinated between the divisions. Within the Board of Management, Bodo Uebber will additionally assume overall responsibility for procurement. Uebber has been a member of the Board of Management of DaimlerChrysler since December 16, 2003, and responsible for Finance and Controlling/ Financial Services from December 16, 2004.

Zetsche says Daimler’s goals are “we will be the leading manufacturer of premium products and a provider of premium services in every market segment we serve worldwide. And we will pursue our commitment to excellence based on a common culture, a great heritage of innovation and pioneering achievements and – with Mercedes-Benz – the strongest automotive brand in the world.

“We have a strong starting position. We have an above-average financial power. And our future prospects are promising.” The Group has defined the following main areas for continued growth:

o Further expansion in the core business, which means in the traditional segments that are the most profitable and have the highest growth rates, as well as exploiting new market opportunities on a regional basis.

o Continued development of innovative, customer-oriented and tailor-made services and activities, pursuing opportunities both up and down the value chain.

o Strengthening leadership in sustainable, responsible and environmentally friendly technologies.

One of the strategies that worked for the former DaimlerChrysler was an effective global procurement and supply organization in place to purchase products and services to its group companies. This organization comprised the Mercedes Car Group, Van Materials Procurement, Chrysler Group Purchasing and Procurement and Truck Group, Buses Materials Procurement and International Procurement Services.

“Our key objective in all of our procurement activities is to increase corporate value through optimized purchasing systems and processes. To this end, we have established an effective global supplier network in order to further improve the quality, technology, costs and logistics associated with the procured materials and services. This approach has been successful, as demonstrated by the fact that the Association Materials Management, Purchasing and Logistics (AMMPL) presented its coveted Innovation Award to our International Procurement Services unit (IPS) for its globalization concept, which has led to a sustained increase in the efficiency of the unit’s procurement processes and tools,” says the company.

So while most of the Mercedes Car Group’s vehicles are manufactured in Germany, the company also has production facilities in the United States, France, South Africa, Brazil, India, Malaysia, Thailand, Vietnam, Indonesia and China. The Group’s most important markets in 2006 were Germany with 28% of unit sales, the other markets of Western Europe (34%), the United States (20%) and Japan (4%).

“With our global procurement management, long-term contracts with key suppliers, and close collaboration with reliable partners, we benefit from a broad spectrum of instruments that allow us to secure deliveries to our plants and limit the impact of rising raw-materials prices on our production costs – even in the face of the current challenging situation on the international raw-materials markets,” says the company.

Extended Enterprise Program

One of the main planks of Daimler’s global relationship with its suppliers is the company’s Extended Enterprise program. This program is based on evaluation of key supplier data and expectations by the company on supplier conduct. Within the framework provided by Extended Enterprise, the performance of each supplier is analyzed and assessed from a global perspective. Initially, the analysis focuses on four main value drivers: quality, technology, costs, and logistics. These criteria are contained in the globally standardized External Balanced Scorecard (EBSC), which translates our strategic goals regarding purchased products and services into measurable data. Procurement employees and suppliers alike can access the EBSC via a Web-based application. In addition to ensuring that suppliers always have a clear picture of their own performance, this also motivates suppliers to consistently and continually improve their performance in the global competitive field.

Top suppliers

Outstanding suppliers were rewarded with coveted awards from DaimlerChrysler. The 2006 DaimlerChrysler AG Global Supplier Awards were presented at the 100th Annual North American International Auto Show in Detroit. The winners came from three continents and including Mitsubishi Electric Corporation, Japan (electrical/electronics), Seton Company, U.S.A. (interior), REHAU, Germany (exterior), Cooper-Standard Automotive, U.S.A. (powertrain), Kuka Schweissanlagen Group, Germany (production equipment and services), Mediterranean Shipping Company, Switzerland (logistics).

“At DaimlerChrysler, the contributions of our suppliers are indispensable to our success and we applaud our 2006 Global Supplier Award Winners for their outstanding efforts last year. Mutual achievements can only be realized through high standards, close cooperation and leveraging the strength of our entire supply chain,” said Thomas W. Sidlik, then DaimlerChrysler AG Board of Management Member, responsible for Global Procurement and Supply, speaking at the award presentation.

Criteria

Suppliers who won the DaimlerChrysler awards must have done a minimum of three million Euro worth of business with multiple divisions of DaimlerChrysler. Nearly 175 suppliers met this criterion. The company says that the key value drivers for evaluating outstanding performance are in the categories of quality, technology, cost and supply, which form the core of the Extended Enterprise business strategy of cooperating with its suppliers. Supplier plans are also drawn up for key global suppliers. These plans contain thorough, in-depth analyses of suppliers and their cooperation with the group.

“The purpose of this analysis, which covers several business units within the Group, is: to extensively study at an early stage the core issues for our medium- to long-term collaboration, to document the results, and to discuss them with our suppliers’ top management. The scope covered includes the suppliers’ overall strategy, core competencies, financial position, and a wealth of other aspects related to collaboration with DaimlerChrysler. Ecological issues, such as the development and utilization of environmentally friendly technologies, materials, and production techniques, are also analyzed, evaluated, and discussed. These comprehensive analyses enable us to identify and discuss potential challenges before they become an issue. In this way, we can initiate effective corrective measures before a concrete response is required,” says the company.

Supplier Portal

Apart from incentives like awards, another key supplier management instrument DaimlerChrysler uses is its supplier portal, which gives its suppliers access to nearly all applications at the Group that are relevant to procurement. Suppliers who use the portal can go online and call up all data related to their partnership with the company. The system offers 50,000 active suppliers access to more than 160 applications for procurement and delivery. Companies interested in doing business with the group can obtain a comprehensive overview of the Group’s purchasing strategy.

Automotive Industries (AI) spoke to Frank W. Deiss, head of global procurement and supply, Mercedes Car Group shortly before the take-over was announced.

AI: In the beginning of the year DaimlerChrysler recognized six suppliers for their outstanding efforts in 2006. What does it mean to a supplier to be considered a contender or even to achieve the DaimlerChrysler AG Global Supplier Award?

Deiss: The awards are DaimlerChrysler’s way of honoring top performers within our supply set. Each year suppliers that demonstrated superior performance in quality, technology, cost and supply are being honored in the categories electric/electronics, interior, exterior, powertrain, production equipment and services and logistics.

The criteria quality, technology, cost and supply are at the heart of Extended Enterprise, the global procurement strategy of DaimlerChrysler. These value drivers allow us to recognize outstanding performance. This assessment also influences the decision-making process for future contracts, which means that an outstanding performance of a supplier leads to a consideration for future contracts.

AI: How is globalization affecting the relationship between Mercedes-Benz and its suppliers?

Deiss: Globalization offers both challenges and opportunities to OEMs and suppliers. For instance, we use the advantages from Global Scale Leverage by bundling and coordinating purchasing volumes worldwide. Challenges include the ever rising costs for raw materials and overcapacities especially in growth markets. Moreover, logistics and supply have to be handled with more effort, for instance if we are talking about global locations in countries or areas with a poor infrastructure.

AI: How do you meet the challenges of rising cost of materials with the suppliers?

Deiss: The key is to work together with our suppliers to achieve continuous improvements in products and processes, as well as realizing price advantages. Wherever necessary and possible, we enter into long-term agreements to maintain our supply of materials and to minimize the impact of future price rises; this also enhances planning security for our suppliers. A good example is our steel resale program, which uses the purchasing power bundling our own demand and supplier’s needs for steel and to pass-on cost advantages to its supply base. I am happy to say that the Mercedes Car Group despite the additional impact of raw material prices, was able to achieve a net reduction in production material costs in 2006.

AI: What are the key value drivers behind

DaimlerChrysler’s Extended Enterprise business strategy?

Deiss: There are four hard and three soft parameters in our Extended Enterprise: quality, technology, cost, supply as well as communication, commitment and integrity. Within the framework of Extended Enterprise and with the aid of a scorecard model, we analyze and evaluate the procurement and supply performance of our suppliers from a global perspective. Through our internet-based Supplier Portal, suppliers can see in real time, 24 hours a day, how they measure up to the four objective performance criteria.

Additionally we discuss individual performance, supplier capabilities and agree on measures for continuous improvement. I am proud that the Mercedes Car Group procurement organization has been recognized with the “EPCON Award” 2007 by IIR (Institute for International Research) recently. We received the award for the successful development and implementation of our supplier performance and feedback system which is based on the External Balanced Scorecard.

AI: How does the Extended Enterprise and External Balanced Scorecard help you manage the quality issues of tier1 and tier 2 suppliers?

Deiss: Complexity is continuously increasing, so managing all interfaces along the entire supply chain, and thus ensuring quality, remain an important issue of competitiveness. As the supplier share for the value add in today’s vehicles is very high, it is clear that continuous optimization of collaboration and processes must be an absolute priority for us. The Extended Enterprise philosophy builds an excellent framework to establish clear requirements and expectations.

Let me give you an example: In order to ensure consistent quality management we reorganized the supplier quality assurance for purchased items. We did this by centralizing the quality management with a focus on prevention for all purchased items for new products and model upgrading. Wit the enhancement of this process, we reached another milestone in building a continuous and sustainable supplier quality management.

The point is this: We expect our suppliers to align their supply chain in a process-oriented manner, in the same professional way as we do, and to ensure cost optimization in conjunction with a simultaneous improvement in quality and processes.

AI: How valuable is the suppliers’ contribution in terms of technology and innovation to Mercedes Car Group (examples of co-operation)?

Deiss: It is important to get the suppliers involved early now that technology is changing so rapidly. The innovative ideas of suppliers are extremely important to the Mercedes Car Group.

The purchasing division acts as broker and facilitator in this context between the supplier and our research and development unit. What is important is that we take all supplier ideas seriously and test these promptly for their feasibility. Our understanding of innovations is to create something tangible and comprehensible for the customer, and that has genuine added value for our vehicles. History shows that many of the most significant automotive innovations have been developed between Mercedes-Benz and its suppliers. ESP or the airbag come to mind.

AI: Do you see the role of your purchasing team more as a link between your R & D team and the suppliers?

Deiss: Definitely, and even more than that: As we fully integrate our suppliers into our continuous optimization efforts the role of my purchasing team is to serve as a supportive interface between various departments and the supply base. Our main target is to achieve continuous optimization of products and processes, and thus, in the end, of the entire value-added chain, in collaboration with our development, cost planning, and purchasing activities.

AI: How do you see the emergence of the supply base in non-traditional, low cost countries?

Deiss: Emerging Markets play an increasing role, for DaimlerChrysler’s procurement division as well as for our global supply base.

For instance, to support DaimlerChrysler’s expansion of production activities in the Asian market, we have intensified our involvement there. We operate purchasing offices in Beijing, Shanghai, Singapore, and Budapest. These offices are not only responsible for procurement in the regions but also have the function of improving the transparency of these markets and their supplier landscape.

For sourcing, we see China, India and Eastern Europe as offering significant opportunity in the global automotive market as well as to support regional production. In addition DaimlerChrysler has a network of local procurement organizations at different locations worldwide. This enables a direct access to relevant procurement markets. Our presence on-site enables us to guarantee compliance with DaimlerChrysler requirements regarding our four value drivers – quality, cost, technology, and supply.

I want to emphasize that DaimlerChrysler expects world-class performance from all its suppliers, no matter where they are located. Based on this performance, traditional and non-traditional suppliers have an equal chance to participate in our supply base.

AI: What are the priorities for purchasing at Mercedes Car Group in 2007?

Deiss: At the end of 2007, the transformation program for the Mercedes Car Group, called CORE, will come to an end. At the purchasing department, we will work to finish implementing the various measures that we developed under this initiative.

But an intensive cooperation between OEM and supplier to optimize cost and quality will be a crucial point for success in future as well.

Many of these CORE measures were already used for the development of the new C-Class which recently had its world-premiere. Looking at the new vehicle the ongoing trend of modular usage had a positive effect on the overall costs. For example we are now using a door module for the C-Class, which replaces around 90% of the single parts we purchased before. Module parts like this reduce assembly times as they can be fixed with only a few grips. In general modularization and standardization will be in the focus of the future development and purchasing strategy, as this has a positive effect on cost and quality concurrently.

Moreover, as the automotive industry is becoming more and more challenging, a fundamental key to success in purchasing is a well organized risk management system. It became a key component for managing our supply base and sourcing decisions at our organization already, but there is still some work to do.

Progress made by Chrysler under Daimler management

According to Dieter Zetsche, Chairman of the Board of Management of Daimler AG.

– Productivity increased dramatically: “Hours per vehicle” dropped from over 48 before 2001 to just over 30 today. Chrysler plants now rank among the most efficient and flexible in the world

– Quality has improved more than 40% over the past six years

– Material and fixed costs have come down significantly

– At the same time, competitive investments in new production facilities and technologies since 2002 total more than $10 billion

– And with 34 new vehicles launched since 2001, Chrysler has one of the youngest product lines in the industry.

More Stories

MESSRING completes new crash test facility for Mahindra in India

ROHM Develops an Ultra-Compact MOSFET Featuring Industry-Leading* Low ON-Resistance Ideal for Fast Charging Applications

More than 30 of the top 50 global suppliers have production facilities in Turkey