OEMs supplying the European market have been provided with more guidance on future regulations following the release of Euro 7 proposals by the European Commission in November 2022.

“The Euro 7 proposals represent an important step forward for reducing air pollution, especially from heavy-duty vehicles. For light-duty transport, affordable technology could allow for more ambitious aspects in the final legislation,” commented Anish Taneja, Chief Executive of Clean Air at Johnson Matthey.

“Now, we cannot afford to waste time in reducing air pollution and ultimately saving lives. This is the first step in the legislative journey, and we need European Parliament and Council to reach swift agreement on a sound Euro 7 for both heavy and light-duty transport. While Europe transitions towards ZEVs, clean and efficient internal combustion engine vehicles still have a key role to play for decades to come.”

Automotive Industries (AI) asked Andy Walker, Technology Market Insights Director at Johnson Matthey, what the new regulations mean for manufacturers.

Walker: This European set of standards for light and heavy vehicles dates back to 1992 with the introduction of Euro 1. We have come a long way in terms of improving the air quality and emissions from those vehicles, but there is still a lot of work to be done. As long as there are combustion engines on the roads, they need to be as clean as possible. And Euro 7 is the mechanism to do that in Europe.

It is a great opportunity to help improve air quality for Europe, and also sets a benchmark for the rest of the world. China and India, for example, have been looking very closely to Europe on how they develop their own standards.

AI: What new catalytic technology will be required to meet the standards?

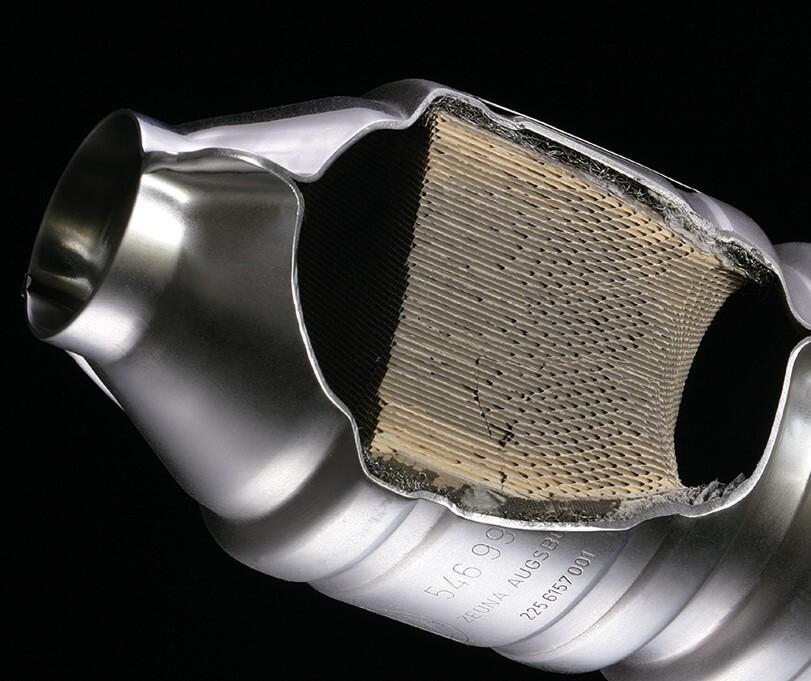

Walker: There’s a range of things you can do from the engine all the way through to the tailpipe. Johnson Matthey focuses on the exhaust gas emissions. The selection of catalysts depends on factors such as your fuel, and the complexity of the vehicle in terms of its raw emissions.

A range of different catalysts can be used in one system. In diesel, for example, there are diesel oxidation catalysts, particulate filters, and selective catalyst reduction (SCR) technology to reduce the emission of nitrogen oxides (NOx). Looking at the key emission criteria, it is often the NOx and particulates which are cited as the most harmful to health. We have tested and demonstrated these systems, and the emissions are extremely low.

AI: So why do we need to follow the fully electric vehicle route then?

Walker: My short answer to that is that we need all the technologies in order to get to net zero emissions. It needs a combination of electric zero emission vehicles powered by batteries or fuel cells as well as minimal emissions from internal combustion engines. The industry is steered by the EU’s trajectory, which is set at banning the sale of new vehicles powered by internal combustion engines from 2035.

In addition, we are projecting that the costs of battery electric vehicles will continue to come down. At the point where they approach the cost of o

ne driven by an internal combustion engine the market elsewhere will switch. In most parts of the world electricity is cheaper than gasoline and diesel. But, overall, it is a complex question.

AI: What about heavy duty vehicles?

Walker: Here there is a lot of interest in hydrogen internal combustion engines. From an emission perspective, pure hydrogen does not contain carbon, so there are no CO2 emissions, but there will be some relatively small NOx at the tail pipe, which means that those systems still require emission control. Again, there’s conversations going on with the with the regulators around the acceptability of the hydrogen internal combustion engine. The appeal lies in the fact that it extends the life of internal combustion engine technology, particularly in heavy commercial vehicles, and the non road mobile machinery space.

We also see fuel cells playing an increasing role in a number of mobile machinery applications, such as heavy-duty trucks and, to some extent, in passenger cars, although we do expect batteries to be the main power source for cars going forward. Johnson Matthey has a range of products for fuel cell technology, which have been working on for over two decades.

AI: How will this transition affect platinum demand?

Walker: Over time we will see decline in the demand for platinum group materials in the automotive catalyst sector, but demand on the fuel cell side is growing. There is a lot of PGM in the market in the form of car exhaust catalysts and they are being recycled at very high efficiencies, so we will see a mix of recycled and primary metals, depending on the application.

AI: What does this mean for Johnson Matthey?

Walker: While Johnson Matthey started off as a precious metals company, and we remain the global experts in precious metals technology and their markets, we also do a lot now in base metals. For example, selective catalytic reduction technology is based on copper rather than platinum group metals. We are also active in other processes to make things like sustainable aviation fuel, for example, which again, are not based on platinum group metals. So, there is quite a lot of diversification across the broad field of clean energy transition.

AI: How are you working with OEMs through this transition?

Walker: For the past 50 years, since the first emissions regulations came out of California, we have been at the vanguard of emission control technology. So, we have really long-standing relationships with our customers. We have been there for them to meet the evolving emission standards, not just in Europe, but all over the globe. And we will continue to be there to help them by working together with them to match our technology with their power trains. Together we will comply with the Euro 7 regulations.

The objective is to find the best way to meet any given set of regulations with the right level of robustness at the lowest cost.

AI: Will there be a Euro 8?

Walker: Our view, and that of the majority of the auto industry in Europe is that Euro 7 will be the last round because the objective is to stop selling new internal combustion engine powered cars by 2035. Realistically, the earliest Euro 7 could be implemented is in mid-2025. There is not going to be time for any further tightening of the regulations. The broader industry believes that the same is true on the heavy-duty side.

Overall, we hope that the EU will go further than the Commission proposal on the light duty side, and set an ambitious set of targets to make sure that we do not need to go through different generations, as we have seen with the different Euro stages. Let us see how far the technology can go and aim at getting it right first time.

More Stories

Acoustic sensor systems and Fraunhofer measurement technology for in practical testing ͏

OSI Systems Receives $10 Million Order for Cargo and Vehicle Inspection Systems

Mitsubishi Electric Automotive America Launches Guardian Generation 3 Trial with Seeing Machines in North America