Shifts in global logistics distribution patterns have sparked a fresh wave of investment in pure car and truck carriers (PCTCs) by shipping lines.

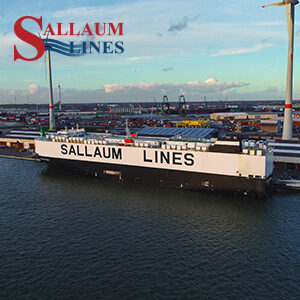

One of the companies investing in new-generation vessels is Sallaum Lines, an international ocean transportation company that has been providing global RoRo cargo shipping services from the EU and USA to North, West, and South Africa since 1991. It is ranked as the 10th largest vehicle carrier in the world with a lifetime number of over 3,000,000 Car Estimated Units (CEU) shipped by the end of 2021.

Sallaum Lines’ owned and chartered fleet of 10 vessels consists of modern PCTC vessels designed to handle a variety of vehicles and high and heavy cargoes. Sallaum Lines specializes in global RoRo shipping and vehicle logistics, managing the distribution of cars, trucks, rolling projects and breakbulk to customers all over the world.

The company’s vision is to create global prosperity for businesses and individuals in the freight sector through sustainable and eco-friendly shipping services. It says its main goal is to move towards a sustainable future by achieving zero emissions by 2050.

Automotive Industries (AI) asked Sami Sallaum, Vice President of Sallaum Lines, what services the company provides in addition to seaborne transport.

Sallaum: Our expansion plan is the offering of finished vehicles logistics with a focus on the European market. Sallaum Lines considers finished

vehicle logistics as a compelling investment into the future to facilitate the supply chain, storage and distribution of finished vehicles.

LMC Automotive forecasts a dramatic increase in global vehicle production in 2022, whereby four million additional vehicles will be produced compared to that of 2021. Hence, the global supply chain market size is expected to reach $42.46 billion by 2027, rising at a market growth of 10.4% CAGR during the forecast period. Therefore, now is the best time for Sallaum Lines to improve its supply chain services for Finished Vehicle Logistics (FVL).

AI: Are you investing in new vessels?

Sallaum: With sustainability being a core value in our business, we are in accordance with the International Maritime Organization’s goals to reduce carbon emissions by 40% by 2030. Therefore, our action plan includes placing the orders of dual-fuel LNG ships in the near future. Our fleet currently consists of 10 PCTCs, with a vision to at least double the fleet in the next decade.

AI: Is there a shortage of RoRo vessels and services?

Sallaum: The PCTC market has seen a rapid recovery and is currently firm. But it is facing some hopefully short-term challenges due to the lack of semiconductors and the impact of the Russia-Ukraine war on the auto industry.

Therefore, the PCTC trade has seen very limited renewal and fleet growth since 2013 and close to zero net growth from 2019-23.

The current firm newbuilding order book remains reconcilable, standing at 7% compared to the sailing fleet.

Another factor for the shortage of RoRo vessels is the limited number of yards building PCTC vessels, with 26-30 months ordering time for potential new vessels. With the positive outlook for GDP growth in the coming years, historically well correlated with car sales, we expect the fleet utilization to stay high and c harter rates to remain very firm.

harter rates to remain very firm.

AI: With your expanding service, what ports do you now regularly call on?

Sallaum: We are covering over 30 ports within the North and South Atlantic Ocean.

Our main routes are as follow:

- Europe to West Africa

- Europe to South Africa

- Europe to USA

- Europe to Mediterranean Sea

- South, West and North Africa to Europe

- USA to West Africa

AI: How are you reducing the carbon footprint of vehicle transport?

Sallaum: We have set a long-term target of net-zero emissions of greenhouse gas (GHG) by 2050. The goal and mission are to reduce the CO2 emissions per transport work by retrofitting our fleet along with greening our operations.

Our retrofitting includes fitting fuel optimizers, improved ballast water treatment systems, utilizing cleaner fuels, and installing exhaust scrubber systems.

AI: What will be the short and long-term effects of the Russian invasion of the Ukraine on global automotive logistics?

Sallaum: Many manufacturers have halted imports to Russia, and some even suspended production until further notice. The Russian market consisted of 1.6 million vehicle sales in 2021 out of which 20% were imported.

The bigger impact is on the supply chain of vehicle manufacturers. For example, Ukraine is the key exporter of neon gas, which is used in the production of semiconductors for the auto industry.

Germany imports one-fifth of palladium from Russia, which is used to produce catalytic converters. Russia is also a major supplier of nickel ore, which is used to produce lithium-ion car batteries. (Source: Autonews)

Hence, we are facing lower vehicle production.

Spiking fuel prices is another challenge the industry is facing.

Fuel is one of the highest costs in shipping and logistics, which will force a substantial increase in freight rates.

More Stories

RAM Trucks in Toronto: Why CarHub North York Chrysler Delivers the Best Experience

Buying Car Insurance in Toronto? Don’t Make These Rookie Mistakes

Extend Your Range, Maximize Your Storage with FRDM’s 45 Gallon Combo